If your business is involved in international trade and your operations include importing or exporting goods, being aware of the intricacies and implications of your transactions and trade deals is essential. Hence, the importance of having a sound understanding of the various Incoterms that state who is responsible for the transportation and delivery of goods.

After covering FOB and Ex Works in our previous Incoterms Guides, today, we tackle two other frequently used Incoterms: Delivered Duty Paid (DDP) and Delivered At Place (DAP).

Which costs and responsibilities are borne by the seller and the buyer under these Incoterms, and what are the other implications of these trade agreements? Read this guide!

What Is Delivered Duty Paid (DDP)?

Under DDP, the seller assumes full responsibility for delivering the goods to the buyer's specified location.

This includes all costs and risks involved, covering export and import duties, taxes, and any other charges related to transporting the goods to the final destination.

The buyer benefits from a hassle-free experience, as the seller manages the entire shipping process, ensuring the goods are delivered right to their doorstep without additional charges.

What Does DDP Imply?

- DDP advantages the buyer

The seller bears all transportation costs and associated risks. Hence, this Incoterm favors the buyer since the seller manages the entire shipping process, ensuring a seamless delivery to the buyer's specified location. - The seller is responsible for exporting and importing the goods

The seller must obtain all necessary export and import licenses, covering all duties, taxes and other charges. - The seller handles customs clearance in the origin and destination countries

This ensures that all customs-related formalities are managed by the seller, providing a hassle-free experience for the buyer. - DDP can be one of the most expensive Incoterms for the seller

Due to the seller covering all costs and risks, DDP can be one of the more expensive options for sellers. However, it can be an attractive option for buyers who prefer a straightforward and predictable shipping process.

What Is Deliverd At Place (DAP)?

Under DAP, the seller is responsible for all costs and risks associated with transporting the goods to the agreed destination, except for import duties and taxes.

This includes export duties, transportation costs, and unloading the goods at the destination. The buyer is responsible for the import customs clearance and any applicable duties and taxes once the goods arrive.

DAP offers a balanced approach, with the seller handling the majority of the logistics while the buyer takes care of the final import formalities.

What Does DAP Imply?

- DAP balances responsibilities between buyer and seller

While the seller handles the majority of the logistics, the buyer is responsible for import customs clearance and associated costs. - The seller is responsible for transporting the goods to the destination

The seller manages all transportation costs and risks up to the agreed delivery location, excluding import duties and taxes. - The buyer handles customs clearance in the destination country

The buyer must manage the import formalities and cover any associated costs, providing them with control over the import process. - DAP can be cost-effective for the buyer

Since the seller covers the majority of the transportation costs, the buyer can benefit from potentially lower overall shipping costs while still having control over the import process.

What About In Practice? Real-Life Examples of DDP and DAP

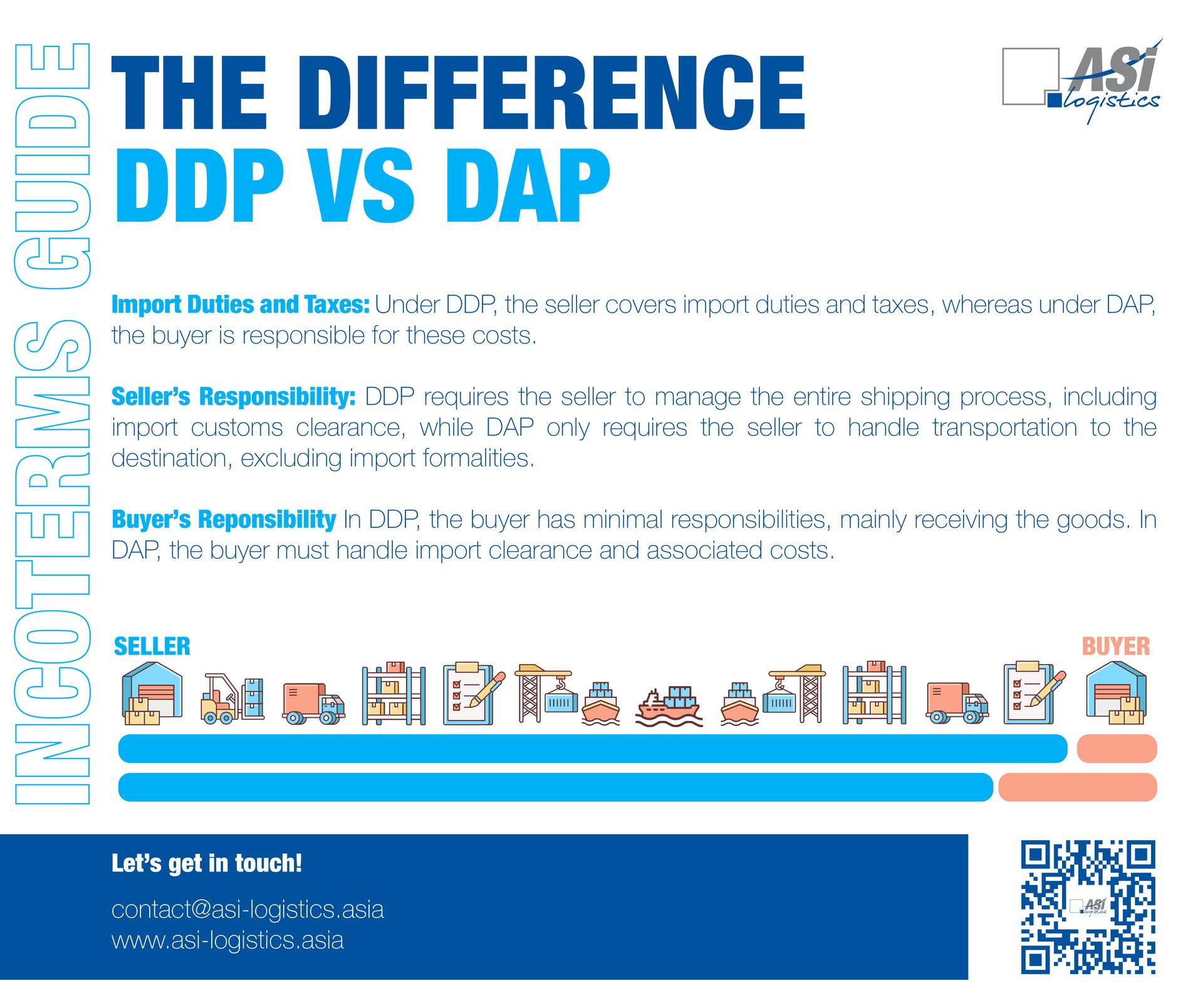

Key Differences Between DDP and DAP

The primary difference between DDP and DAP lies in the allocation of responsibilities for import duties and taxes.

Under DDP, the seller covers all import duties and taxes, ensuring the buyer receives the goods without any additional charges or formalities. Conversely, under DAP, the seller is responsible for transporting the goods to the destination, but the buyer handles the import customs clearance and associated costs.

This means the seller manages the entire shipping process under DDP, while under DAP, the seller's responsibility ends once the goods reach the agreed location, leaving the buyer to take care of the final import stage.

No matter the context, ASI Logistics, strong of 15 years of expertise, provides you with the most adapted logistic solution to fit your needs and ensure you enjoy the benefits of smooth operations.

Thanks to our eight offices, including five conveniently located on China's east coast logistic hubs (Shanghai, Nanjing, Xiamen, Ningbo, and Hong Kong), its two branches in Ho Chi Minh City, Vietnam, and Phnom Penh, Cambodia, and its worldwide network of logistic experts, ASI Logistics accompanies you at every step of your product's journey from, to and within Asia.

Our Values

Get in touch with our teams!

Contact Us